Not sure what the politicians in Washington are seeing when they decide to support fossil fuel over clean energy. They are so out-of-step with the rest of the world, including the business sector that they claim to serve. The rest of us are moving away from what is now an antiquated era of powering our world with oil and coal. Thankfully.

Who knows if the new tax changes get approved. But, it does give us further insight into Trump's approach to energy.

The tax overhaul proposed in the U.S. House looks like a better bet for oil and natural gas companies than solar developers or electric car buyers, keeping with President Donald Trump’s decidedly fossil-fuel friendly views.

The proposal, unveiled Thursday, slashes tax rates almost in half for most corporations, and expands the ability of businesses -- from shale drillers to solar panel makers -- to write off equipment. It keeps most of the oil industry’s most cherished tax breaks intact, as well as investment and production tax credits for renewable energy.

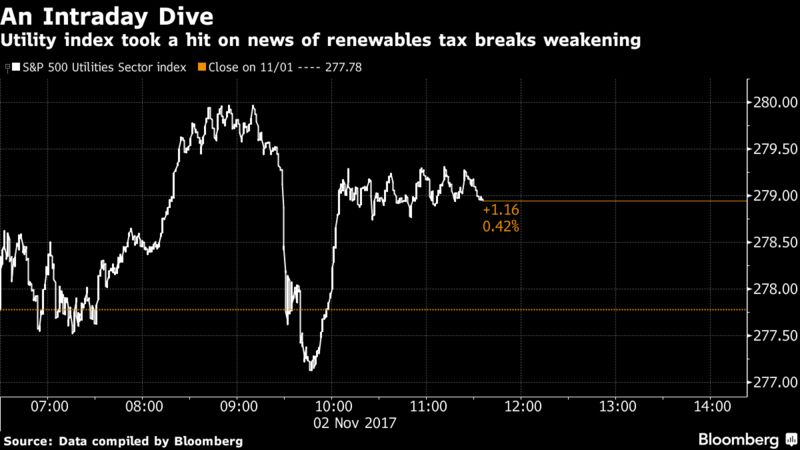

But there are exceptions: A $7,500 credit for electric vehicle purchases is gone, as is a credit for big solar and geothermal projects. Those changes, alongside other tweaks, may make it harder for renewables to attract financing.

“With wind power-heavy states being predominantly Republican, few predicted a reduction in tax benefits for wind farms in the first draft," Angie Storozynski, an analyst with Macquarie Capital USA Inc., wrote in a note to clients Friday. “If the changes are adopted, which is a big if, we could see a meaningful deceleration in the wind new build in the US and (potentially) lower than expected profitability of wind farms."

It’s possible the bill could change as quickly as this weekend. Representative Kevin Brady, the Texas Republican who chairs the Ways and Means Committee, has indicated he may rewrite the bill ahead of a Monday committee vote, where amendments making further changes could be adopted.

But so far, here’s what we know about what the bill means for energy:

Oil and Gas

The House proposal protects three provisions that save explorers billions of dollars annually, while chopping a few others.

The legislation preserves the use of last-in-first-out accounting rules, also known as LIFO. The rules let companies value crude stockpiles at the price they’re selling for, rather than the original purchase cost. The bill also allows continued deductions of so-called intangible drilling costs and preserves a measure that lets explorers reduce taxable income to reflect the depreciation of reserves.

All three were thought to be in jeopardy as Republicans searched for offsets to pay for lowering taxes elsewhere. Eliminating the drilling and depletion provisions alone would force energy companies to pay about $25 billion in additional taxes between 2016 and 2026, Congress’s Joint Committee on Taxation estimated last year.

The House bill would also end two smaller breaks for “marginal" oil wells and enhanced oil recovery projects, which involve older oil and gas fields. That would cost drillers about $371 million over ten years, the committee estimated.

The plan spares “the Holy Grail of E&P tax breaks" by maintaining the intangible drilling costs provision, analysts at Houston investment bank Tudor Pickering Holt & Co. said in a research note Friday. Between that and a plan to cut the corporate rate from 35 percent to 20 percent, the legislation would be “a net positive for oil and gas," they wrote.

Renewables

While keeping two major credits for wind and solar, the bill would cut the benefit from the wind provision by a third, and wipe out another 10 percent tax credit for commercial-scale solar and geothermal projects after 2027.

While the plan adds credits for other energy sources, such as geothermal, small-scale wind and fuel cells, the overall impact is negative, said Greg Jenner, a Washington-based attorney at Stoel Rives LLP who works with renewable companies. “That’s just a pure revenue grab,” Jenner said in an email.

MORE AT: https://www.bloomberg.com/news/articles/2017-11-02/fossil-fuel-friendly-tax-plan-spares-oil-not-solar-or-tesla

No comments:

Post a Comment